The Trusted Name In KYB

Personalised experiences for every user, one system for your team.

Consolidate all business & individual identity verification, AML screening, compliance workflows and ongoing monitoring into Detected.

Our Partners

We work with global leaders across the Risk, Fraud and Compliance ecosystem in two different ways. The first is to expand our reach, and the second is to continually enhance the capabilities of our platform.

Go-to-Market Partners

Global businesses that trust Detected to solve KYB for their customers. These partners sell Detected's platform as their own offering (white-label) or they sell Detected as part of a joint value proposition (co-sell). The technology and team are focused on enabling partners in both of these models.

Product Partners

Leading technology and data providers that enhance Detected's capabilities, from business data sources to identity verification and compliance services. Detected integrates these partners and allows customers to either contract directly or use the agreements already in place to reduce complexity.

Detected's end-to-end platform is feature rich and proven at enterprise, here are some of the powerful features available as standard.

Here is a snapshot of just some of the features in the platform which consolidates all business & individual identity verification, AML screening, compliance workflows and ongoing monitoring into one platform in 200 countries.

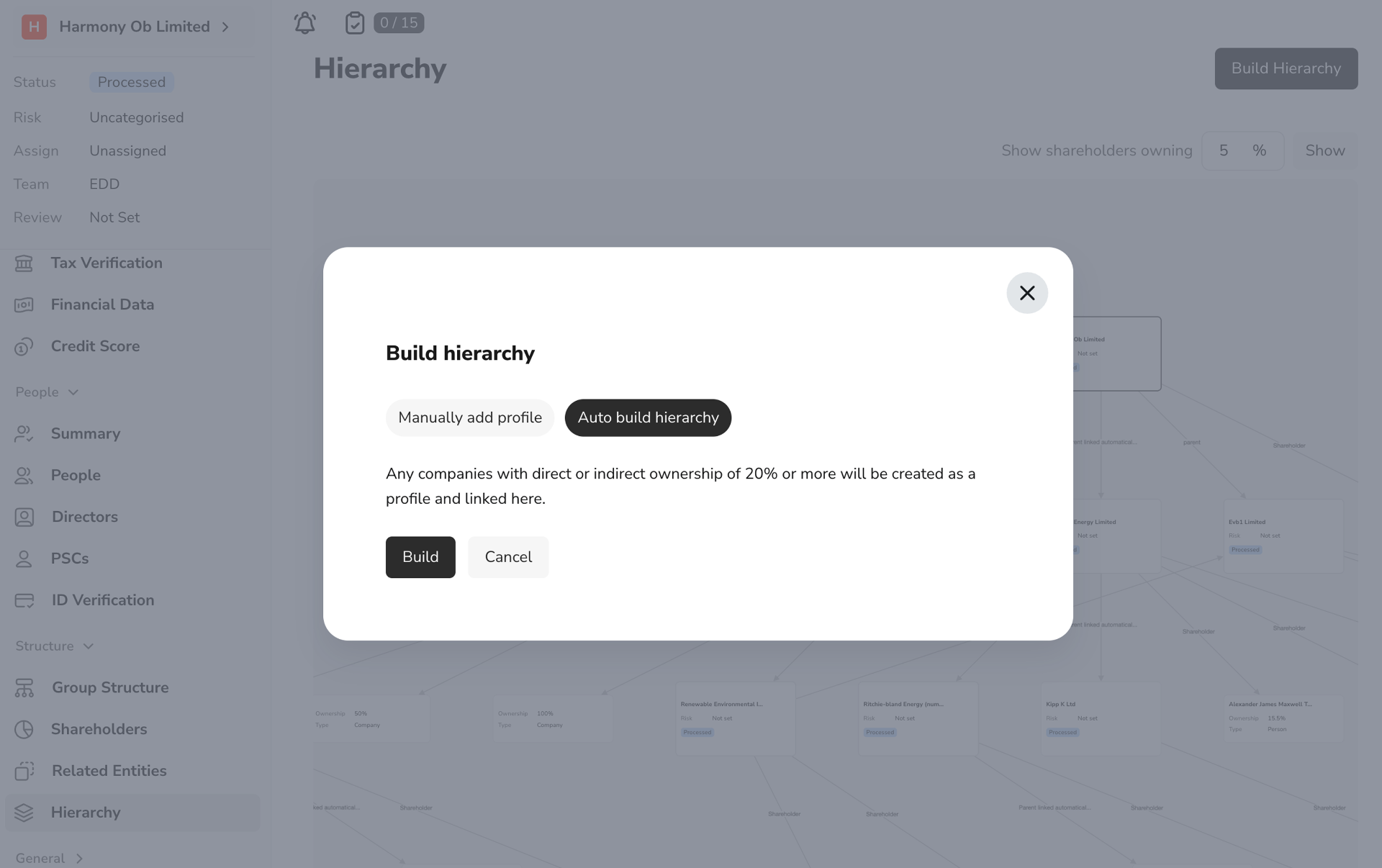

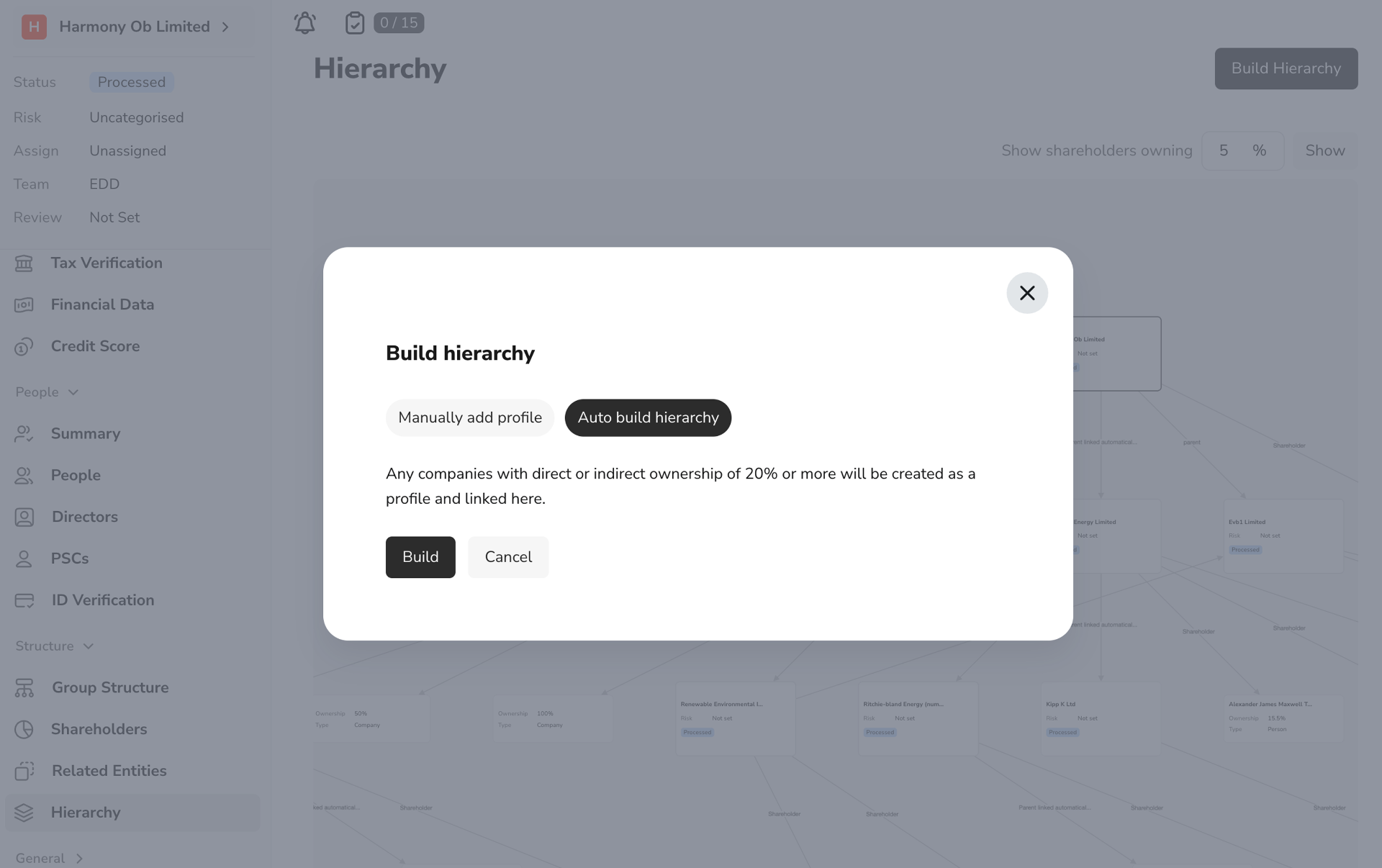

Comprehensive Business Data, UBO Discovery and AML Screening

80% of financial crime risk hides behind complex ownership structures. With Detected, uncover UBOs, directors, and ownership hierarchies instantly. Access the most trusted global company data and run automated AML checks across international watchlists, all in one seamless platform. Stay compliant, reduce exposure and protect your reputation without complexity. Unlike others, Detected brings real-time business data, AML screening and ownership discovery together in a single, intuitive interface.

Comprehensive Business Data, UBO Discovery and AML Screening

80% of financial crime risk hides behind complex ownership structures. With Detected, uncover UBOs, directors, and ownership hierarchies instantly. Access the most trusted global company data and run automated AML checks across international watchlists, all in one seamless platform. Stay compliant, reduce exposure and protect your reputation without complexity. Unlike others, Detected brings real-time business data, AML screening and ownership discovery together in a single, intuitive interface.

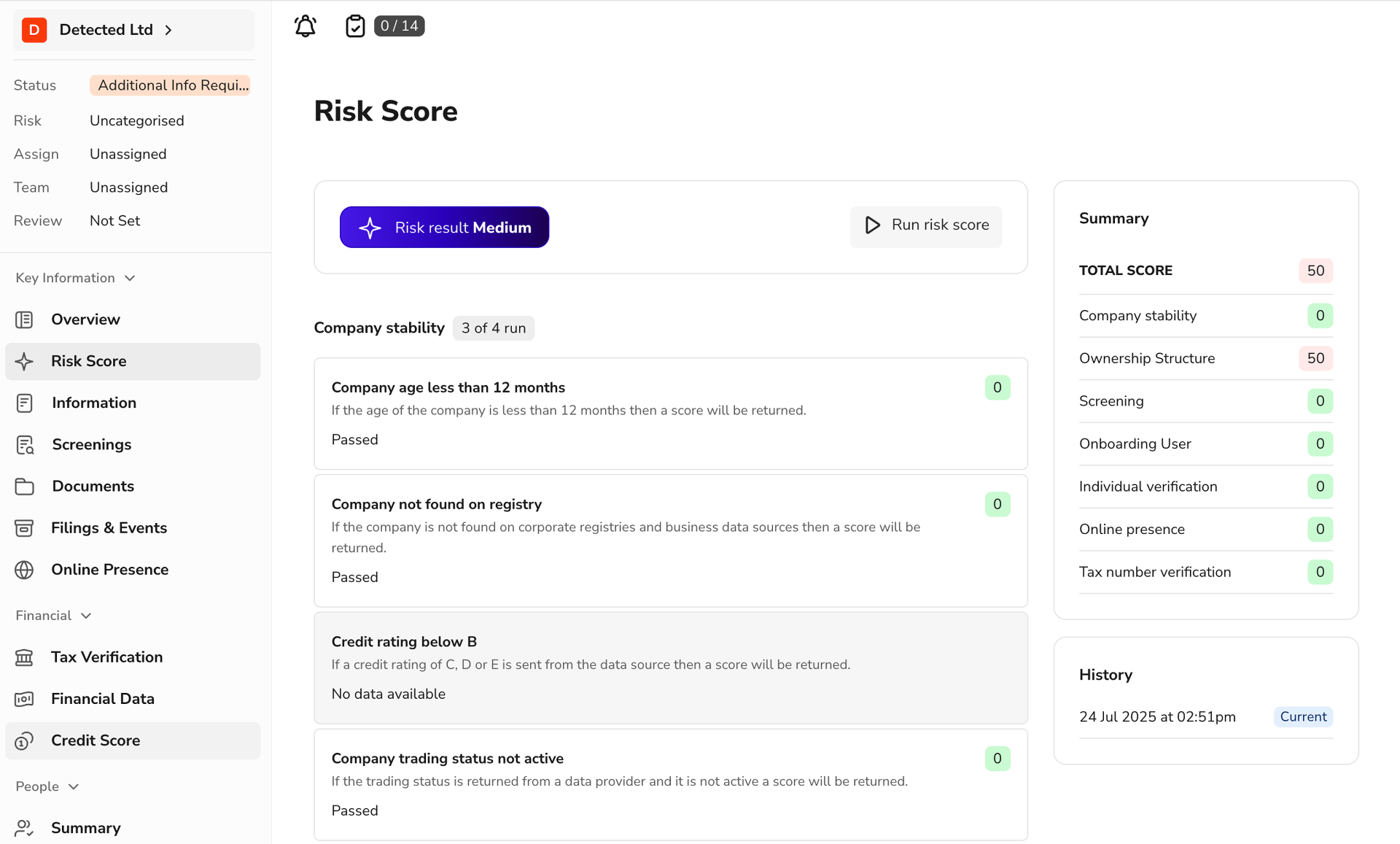

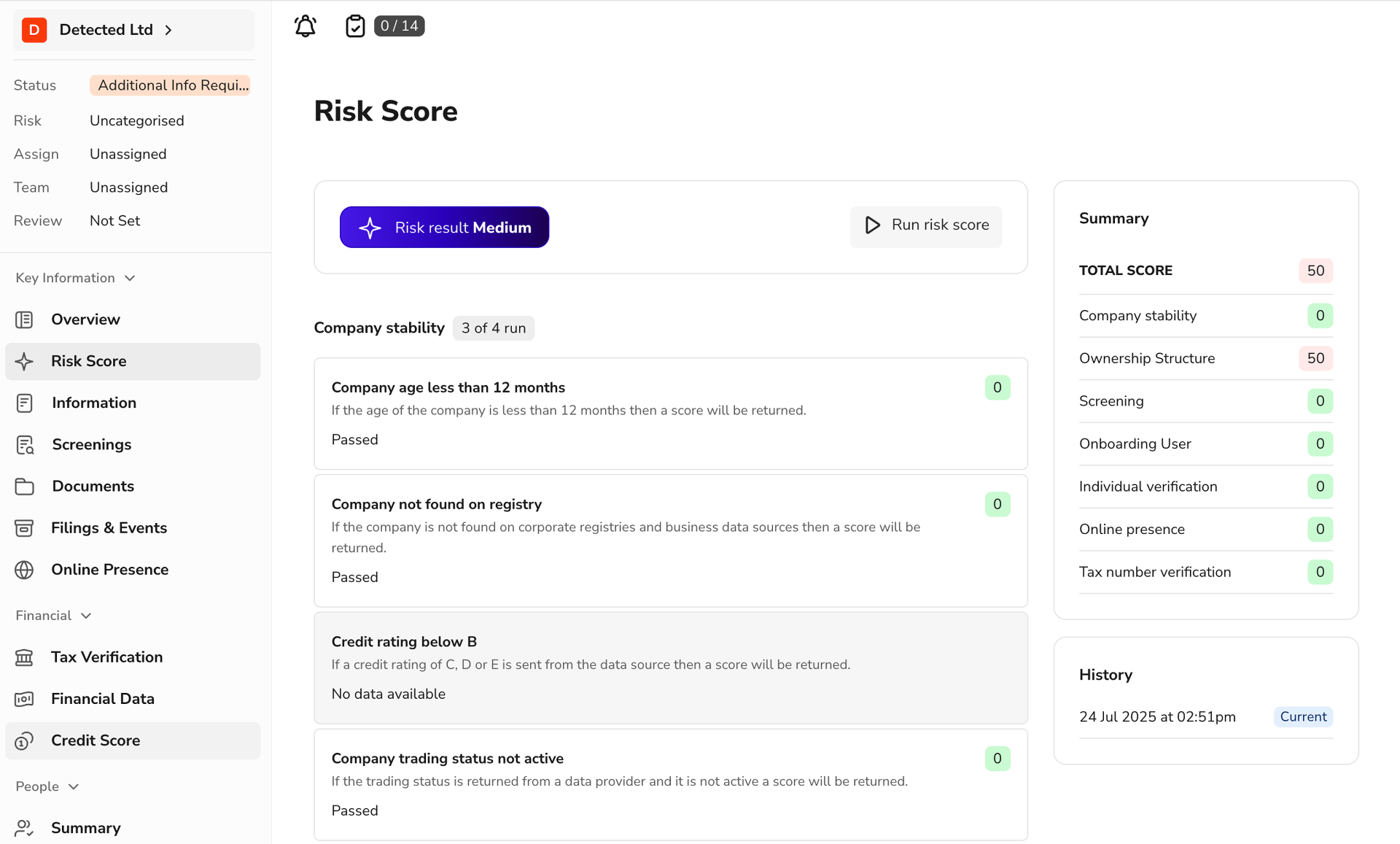

Automatic Risk Engine

Static checks won't protect you from dynamic threats. Move beyond spreadsheets with a configurable risk engine designed for your appetite. Detected combines live data from multiple sources into a single transparent score empowering confident, faster decisions. Other solutions apply rigid scoring models but Detected puts you in control, letting you define the risk rules that matter most.

Automatic Risk Engine

Static checks won't protect you from dynamic threats. Move beyond spreadsheets with a configurable risk engine designed for your appetite. Detected combines live data from multiple sources into a single transparent score empowering confident, faster decisions. Other solutions apply rigid scoring models but Detected puts you in control, letting you define the risk rules that matter most.

Enterprise Case Management

Compliance workflows often break down when teams juggle fragmented systems and manual case tracking. Detected's Enterprise Case Management centralises every onboarding and monitoring activity into a single, auditable workspace. Assign cases, track progress, and collaborate across teams with full visibility and accountability. With intelligent task routing, audit trails, and real-time updates, your compliance operations stay efficient, consistent, and regulator-ready. Unlike siloed legacy tools, Detected seamlessly integrates case management into the heart of your KYB processes—reducing operational friction and accelerating resolutions.

Enterprise Case Management

Compliance workflows often break down when teams juggle fragmented systems and manual case tracking. Detected's Enterprise Case Management centralises every onboarding and monitoring activity into a single, auditable workspace. Assign cases, track progress, and collaborate across teams with full visibility and accountability. With intelligent task routing, audit trails, and real-time updates, your compliance operations stay efficient, consistent, and regulator-ready. Unlike siloed legacy tools, Detected seamlessly integrates case management into the heart of your KYB processes—reducing operational friction and accelerating resolutions.

Front End Customer Application Portal

Frictionless onboarding for better customer experiences. Every extra step in onboarding costs you customers. Deliver a sleek, white-labeled digital portal where customers can upload documents, verify identities, and can collect required data, all without friction and with flows tailored to specific geographies or use cases. Reduce drop-offs, accelerate onboarding and enhance transparency for both customers and your team. Unlike generic onboarding tools, Detected integrates KYB, UBO verification, and AML screening into a single branded experience.

Front End Customer Application Portal

Frictionless onboarding for better customer experiences. Every extra step in onboarding costs you customers. Deliver a sleek, white-labeled digital portal where customers can upload documents, verify identities, and can collect required data, all without friction and with flows tailored to specific geographies or use cases. Reduce drop-offs, accelerate onboarding and enhance transparency for both customers and your team. Unlike generic onboarding tools, Detected integrates KYB, UBO verification, and AML screening into a single branded experience.

Ongoing Monitoring and Event Driven Reviews

Detect changes and stay informed when it matters most. Compliance doesn't stop after onboarding. Detected provides ongoing monitoring through event driven alerts and scheduled reviews. When a trigger occurs such as a new sanctions hit, ownership change or an adverse media hit, your team will be notified immediately. Combined with periodic reviews, this ensures compliance teams act on the latest risk intelligence without unnecessary noise.

Ongoing Monitoring and Event Driven Reviews

Detect changes and stay informed when it matters most. Compliance doesn't stop after onboarding. Detected provides ongoing monitoring through event driven alerts and scheduled reviews. When a trigger occurs such as a new sanctions hit, ownership change or an adverse media hit, your team will be notified immediately. Combined with periodic reviews, this ensures compliance teams act on the latest risk intelligence without unnecessary noise.

Compliance Agents

Manual reviews slow onboarding and exhaust compliance resources. Detected’s Compliance Agents streamline the entire process by intelligently reviewing submissions, validating documents, screening risk data, and accelerating case resolution. Document, Submission, Screening, and Review Agents each handle key tasks with precision- reducing noise, catching true risk, and eliminating manual repetition. You remain in full control, with clear thresholds, escalation paths, and human-in-the-loop governance built in- ensuring speed without sacrificing auditability or oversight.

Compliance Agents

Manual reviews slow onboarding and exhaust compliance resources. Detected’s Compliance Agents streamline the entire process by intelligently reviewing submissions, validating documents, screening risk data, and accelerating case resolution. Document, Submission, Screening, and Review Agents each handle key tasks with precision- reducing noise, catching true risk, and eliminating manual repetition. You remain in full control, with clear thresholds, escalation paths, and human-in-the-loop governance built in- ensuring speed without sacrificing auditability or oversight.

AI that accelerates compliance, without increasing risk.

Detected's AI transforms onboarding and ongoing monitoring by eliminating manual bottlenecks, reducing operational risk, and delivering faster, smarter decisions for global enterprises.

AI Decision Engine

Current Process

Identity Verification

AI Confidence

92%

Processing Time

2.3 seconds

Agent Overview

Document Agent

Analyses documents in realtime as they are provided by the user, classifies and quality checks the documents to ensure the correct documents are being provided during onboarding

Submission Agent

Carefully reviews business application data including documents, forms & ownership data to look for risk and ensure adherence to both internal risk and external regulatory policies

Screening Agent

Automate the review of screenings taking into account the context of the business to make recommendations on accuracy of screening hits, easily identify false positives and improve the accuracy of your screening reviews

Review Agent

Accelerate case reviews by having an agent do an initial review based on your compliance requirements, use it to automate checks, summarise risk and autocomplete checklist tasks.

"Detected's customer-centric approach to the development of Artificial Intelligence is evident in the impact it has for customers. Automating manual processes is top of mind for risk & compliance professionals."

Customer Success Stories

See how industry leaders across industries from Banking and Cross Border FX to Marketplaces and Payments businesses are transforming their compliance operations with Detected.

Zelis is a leading healthcare financial solutions provider that modernizes payments and experiences for payers, providers, and members nationwide. As one of the industry's fastest-growing platforms, Zelis reduces costs, administrative burdens, and friction while optimizing claims, networks, and communications through innovative technology built by experts.

Jurisdiction

United States

Use Case

Customisable Workflows and Case Management

Key Success Metrics

"With over 20 years in the Financial Crime sector, I've used countless KYB platforms- most miss the mark. Detected stood out immediately with its customizable workflows that address the unique nuances of KYB, including secure, seamless due diligence on UBOs. It delivers a dynamic, intuitive onboarding experience for both compliance teams and customers."

Enterprise Impact

By consolidating both front end customer workflows and back end compliance workflows into a single system, additional data intelligence drives faster decisions and lower costs.

A household name, established in 1996 Currencies Direct was the first non-bank foreign exchange provider in Europe. Today they've helped over 425,000 customers, offering straightforward payments solutions to businesses operating in international markets.

Jurisdiction

Global

Use Case

End-to-end KYB

Key Success Metrics

"Detected has allowed us to optimise our onboarding journey for lower risk clients by providing us with the ability to create risk-based onboarding journeys with integrated risk assessment. We were able to create bespoke risk assessments based on key risk indicators and our risk appetite whilst maintaining high standards."

Enterprise Impact

60% reduction in operational hours with automated SMB onboarding and 3x faster time to onboard new clients through streamlined KYB and KYC processes.

Fruugo is a leading global online marketplace that connects millions of consumers with retailers worldwide. As one of the fastest-growing marketplace platforms, Fruugo facilitates cross-border commerce and helps retailers expand their reach to international markets through innovative technology solutions.

Jurisdiction

United Kingdom

Use Case

Marketplace Vendor Verification

Key Success Metrics

"Working with Detected has transformed how we verify and onboard marketplace vendors. The streamlined process allows us to focus on growing our platform while maintaining the highest compliance standards."

Enterprise Impact

Fruugo's implementation of automated vendor verification has revolutionized their marketplace operations, enabling faster expansion while maintaining trust and safety standards across all international markets.

Thomson Reuters generates over $6 billion in annual revenue, helping organisations navigate complex regulatory environments, reduce risk, and drive operational efficiency across legal, tax, compliance, and financial domains. Serving over 400,000 customers across 190+ countries.

Jurisdiction

United States

Use Case

Onboarding and Monitoring of Credentialing Customers

Key Success Metrics

"We are required to complete in depth checks on potential CLEAR customers during our 'Credentialing' process as the data within CLEAR is highly sensitive. Since working with Detected, our internal Credentialing team have increased efficiency by consolidating their work into a single platform."

Enterprise Impact

Significant reduction in onboarding time with streamlined credentialing process and significantly improved customer experience across diverse client types from government agencies to mid-sized investigators.

Founded in 1770, Weatherbys is a seventh-generation, family-owned Bank. The group includes Weatherbys Private Bank, Weatherbys Racing Bank, Arkle Finance Ltd, and insurance broker Weatherbys Hamilton.

Jurisdiction

United Kingdom

Use Case

Syndicate KYB + KYC Workflows

Key Success Metrics

"We faced challenges in the racing segment of the bank, specifically related to the KYB and KYC of Syndicates. Customers found the legacy approach to be invasive and cumbersome- it wasn't until we saw Detected that we believed any solution had the automation and configurability required for this unique challenge."

Enterprise Impact

Transformed syndicate onboarding for horse racing partnerships with automated compliance workflows that reduced customer friction while maintaining regulatory standards for this unique banking segment.

Navan (formerly TripActions) is the leading all-in-one travel, corporate card, and expense management solution for companies worldwide. Serving thousands of companies globally, Navan simplifies business travel and expense management.

Jurisdiction

Global

Use Case

Global Compliance Operations

Key Success Metrics

"Detected has streamlined our global compliance operations, allowing us to scale our onboarding processes efficiently while maintaining rigorous risk assessment standards. The automation capabilities have significantly reduced manual review time for our compliance team."

Enterprise Impact

Scaled global compliance operations with streamlined onboarding processes and significantly reduced manual review time while maintaining rigorous risk assessment standards across thousands of companies worldwide.

Operational Excellence that Delivers, Every Single Time.

From initial mobilisation to ongoing optimisation in BAU, Detected guarantees enterprise-grade delivery for even the most complex global compliance requirements.

"Detected's implementation team delivered exactly as promised, live in 4 weeks. Their operational support has been critical in transforming our compliance operations from reactive to proactive."

Operational Excellence Highlights

Proven On-Time Enterprise Implementations

Custom Project Plans Built for Every Client

Role-Specific Enablement Across Compliance, Sales, Ops, Product

Direct Access to Named Support Specialists

SLA-Guaranteed Support Response Times

Quarterly Optimisation Reviews for Continuous Improvement

The KYB Standard

Detected isn't just a platform, it's the foundation for how global compliance should work. Unified, intelligent, and built to scale.

The trusted name in KYB

Powering compliance operations for enterprises around the world