Abstract

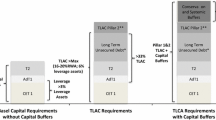

The current banking model is distorted by government subsidy to banks financing risk, in the form of explicit deposits guarantees and implicit bailout guarantees. Starting from the financing model of bank intermediation, we argue for a self-sufficient banking architecture based on the securitization model. We propose the “15/30–20/40” rule relying on a double equity and non-deposit debt/bonds cushion, making client deposits a safe asset that is able to perform its monetary functions without the need for government guarantees. Finally, we show how CBDC can contribute to the stability of the monetary and financial system.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.Notes

Regardless of the form of the CBDC, i.e., a CBDC in the form of an account at the central bank or a distributed ledger based CBDC.

For a discussion of reserve requirements pros and cons see [3].

References

Admati, A.R., P.M. DeMarzo, M.F. Hellwig, and P.C. Pfleiderer. 2013. Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not socially expensive. Max Planck Institute for Research on Collective Goods 23: 13–17.

Birn, M., O. de Bandt, S. Firestone, M. Gutiérrez Girault, D. Hancock, T. Krogh, et al. 2020. The costs and benefits of bank capital—A review of the literature. Journal of Risk and Financial Management 13: 74.

Bitar, J. 2022. A note on reserve requirements and banks’ liquidity. International Journal of Finance & Economics 27 (4): 4837–4852.

Chamley, C., L.J. Kotlikoff, and H. Polemarchakis. 2012. Limited-purpose banking—Moving from “trust me” to “show me” banking. American Economic Review 102: 113–119.

Cline, W. 2015. Testing the Modigliani–Miller theorem of capital structure irrelevance for banks. Peterson Institute for International Economics Working Paper.

Cochrane, J.H. 2014. Toward a run-free financial system. Across the Great Divide: New Perspectives on the Financial Crisis 197: 214–215.

Dagher, J., G. Dell'Ariccia, L. Laeven, M. L. Ratnovski, and M. H. Tong. 2020. Bank capital: A seawall approach. 62nd issue (March 2020) of the International Journal of Central Banking.

Dick-Nielsen, J., J. Gyntelberg, and C. Thimsen. 2022. The cost of capital for banks: Evidence from analyst earnings forecasts. The Journal of Finance 77: 2577–2611.

Hanson, S.G., A. Shleifer, J.C. Stein, and R.W. Vishny. 2015. Banks as patient fixed-income investors. Journal of Financial Economics 117: 449–469.

Hoenig, T. 2013. Basel III capital: A well-intended illusion. remarks to the International Association of Deposit Insurers 2013 Research Conference, Basel, 9.

Jakab, Z., and M. Kumhof. 2018. Banks are not intermediaries of loanable funds—facts, theory and evidence. Bank of England Working Paper.

Werner, R.A. 2016. A lost century in economics: Three theories of banking and the conclusive evidence. International Review of Financial Analysis 46: 361–379.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bitar, J. The case for a less deposit-intensive banking model. J Bank Regul 26, 279–287 (2025). https://doi.org/10.1057/s41261-024-00260-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41261-024-00260-z